Scottsdale Real Estate Update | March 18th, 2018

This Week’s Mortgage Rate Summary

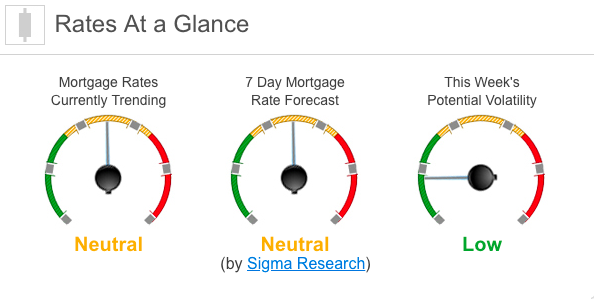

How Rates Move:Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours. Rates Currently Trending: NeutralMortgage rates are trending sideways this morning. Last week the MBS market improved by +10bps. This caused rates to move sideways for the week. Mortgage rate volatility was low for the week. This Week’s Rate Forecast: NeutralThree Things: These are the three areas that have the greatest ability to impact mortgage rates this week. 1) Central Bank, 2) Brexit and 3) Trade. 1) Central Bank: Wednesday, we will get the latest interest rate decision and policy statement from our Federal Reserve. While the bond market is not expecting any action at this meeting, this is one of those meetings where they do release their Economic Projections and Dot Plot chart. While the FOMC has been trying to downplay the value of the dot pots lately, the bond market will be paying very close attention to see if the number of “dots” (FOMC members) have 0, 1 or even 2 rate hikes for this year and next compared to the last dot plot chart that we got. We will also have a very important Bank of England interest rate decision and hear from the Swiss National Bank as well. 2) Brexit: There is a possibility that PM Theresa May could bring a 3rd version of her Brexit deal to Parliament on Tuesday. Regardless, there is a two-day EU policy meeting in Brussels starting on Thursday that will be focusing on Brexit. Any movement that can give the markets less uncertainty would be negative for rates. 3) Trade: The markets seem to have “trade war fatigue,” and you can’t’ blame them. Now, it looks like a summit may be pushed back to June. However, any major (and official) announcements on real policy agreements can have a significant impact on rates. This Week’s Potential Volatility: LowMortgage rates continue to move sideways on low volatility. Other than the Fed policy statement, there’s nothing due out this week that will likely move rates. However, anything unexpected with Brexit or trade could inject some volatility into the market. Bottom Line:If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them. |