Scottsdale Real Estate Update | March 25th, 2018

This Week’s Mortgage Rate Summary

How Rates Move:

Conventional overnment (FHA and VA) lenders set their rates based on the pricing of Mortgageand G-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

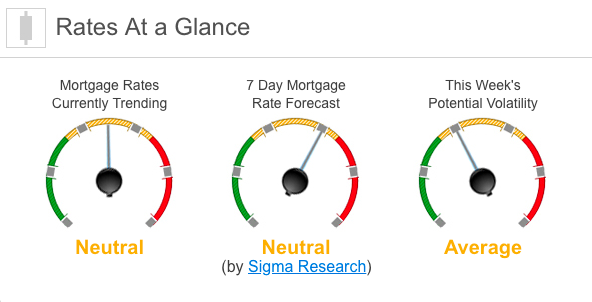

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +50bps. This was enough to move rates lower last week. We saw high rate volatility throughout the week.

This Week’s Rate Forecast: Neutral

Three Things: These are the three things that have the greatest ability to impact mortgage rates this week. 1) Geopolitical, 2) Trade and 3) Inflation.

1) Geopolitical: Brexit continues to take center stage as Prime Minister Theresa May’s cabinet is in full revolt. In a last-ditch effort to get the very unpopular deal pushed through before the deadline, May is offering to resign IF they pass her deal. This deal could be extended to May 22nd or April 12th depending on how some votes go. The markets are also concerned about the military escalation in Israel.

2) Trade: Trade Representative Lighthizer and Treasury Secretary Mnuchin are visiting China this week. With the Mueller investigation over, it’s believed that trade talks may take a step forward now that China has confidence in leadership in the U.S.

3) Inflation: We will get the Fed’s key inflation measure on Friday with the PCE report. The markets are expecting the Core YOY number to remain below 2.0%.

03/28 7 year note

03/29 John Williams