Scottsdale Real Estate Update | April 22nd, 2019

Today’s Mortgage Rate Summary

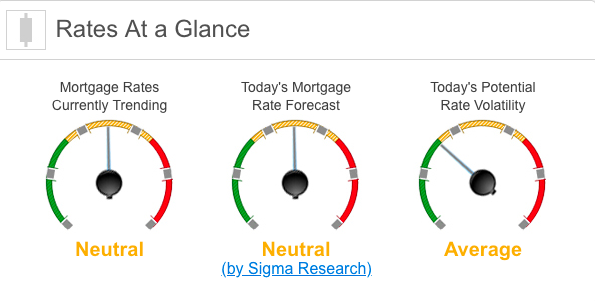

How Rates Move:Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours. Rates Currently Trending: NeutralMortgage rates are trending sideways this morning. Last week the MBS market worsened by -5bps. This was not enough to move rates higher last week. We saw low rate volatility throughout the week. Today’s Rate Forecast: NeutralThree Things: These are the three areas that have the greatest ability to impact mortgage rates this week. 1) GDP, 2) Geopolitical and 3) Central Bank. 1) GDP: We will get our first look at the 1st QTR GDP this week. Around a month ago, market expectations were for a growth rate of only 0.4%, but now that has boomeranged into 1.8% to 1.9%. Any reading above 2.00% would be negative for rates. 2) Geopolitical: No Waivers for You! For the past six months, the United States has let 10 nations know that their waivers (exemptions from having to abide by the trade embargo against Iranian oil exports) would expire. 3 of those nations have already stopped purchasing ahead of the deadline but 5 of them including China and India have still been purchasing until now. This is not a new policy at all and well telegraphed to everyone, but as usual, everyone rides it until the last possible minute. Markets will be sensitive to rising oil prices and any heightened military prospects. The U.K. Parliament is now back from Easter Break, and we will start to get some more Brexit headlines after about 10 days of quiet on that front. 3) Central Bank: This week, we will get the Bank of Japan’s (third largest economy) interest rate decision and policy statement as well as the Bank of Canada (tenth largest economy). Treasury Auctions this Week:

Today’s Potential Rate Volatility: AverageLast week, we saw almost no movement in rates. This week, we do have some news noted above that can increase rate volatility and push rates higher. This is a bit technical, but we’re right on the 50-day moving average for rates. If we jump above that number, we could see rates spike on high volatility. We’ll be keeping a close watch on the economic news to see if anything comes out and surprises the markets. Bottom Line:If you are looking for the risks and benefits of locking your interest rate in today, contact your mortgage professional to discuss it with them. |