Scottsdale Real Estate Update | April 29th, 2019

This Week’s Mortgage Rate Summary

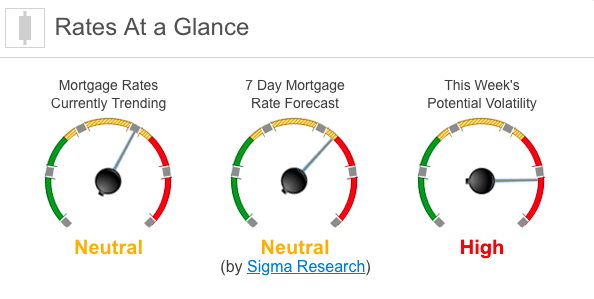

How Rates Move:Conventional government (FHA and VA) lenders set their rates based on the pricing of Mortgage and G-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours. Rates Currently Trending: NeutralMortgage rates are trending sideways to slightly higher so far today. Last week the MBS market improved by +29bps. This was enough to move rates or fees slightly lower last week. We saw low rate volatility through most of the week. This Week’s Rate Forecast: NeutralThree Things: These are the three areas that have the greatest ability to impact mortgage rates this week. 1) Central Bank, 2) Trade and 3) Jobs. 1) Central Bank: We will get key interest rate decisions and policy statements from 2 of the top 5 economies this week starting with our own Federal Reserve on Wednesday and then the Bank of England on Thursday. Based upon the recent Beige Book, there would appear to be nothing out there that would cause the Fed to take action at this meeting. The markets will be very sensitive to the live press conference afterward. 2) Trade: The U.S./China Trade War will wake up once again take center stage as meetings resume in China Tuesday as US Trade Representative Lighthizer and Treasury Secretary Mnuchin will be in Beijing to continue with another round of trade talks. The latest suggestion was that both sides were working to reach a draft agreement for some time in May with talks next week covering “trade issues including intellectual property, forced technology transfer, non-tariff barriers, agriculture, services, purchases, and enforcement”. Chinese Vice Premier Liu He is then expected to travel to the White House on May 8th. 3) Jobs: We get a ton of income and jobs related data all week culminating in Big Jobs Friday. The focus will be on the Average Hourly Earnings YOY which is projected to jump from 3.0% up to 3.4%. If that is the case, then we will see the week end on a down note for rates. But if it remains at 3.0% or below, then rates will remain solid. This Week’s Potential Volatility: HighThere’s a lot of economic activity this week that can cause rates to move and increase volatility. Most of the likely movement is for slightly higher rates. The two things that could push rates lower and increase volatility is a dovish sounding Fed and a breakdown in China trade talks. Bottom Line:If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them. |