Scottsdale Real Estate Update | July 8th, 2019

This Weeks’ Mortgage Rate Summary

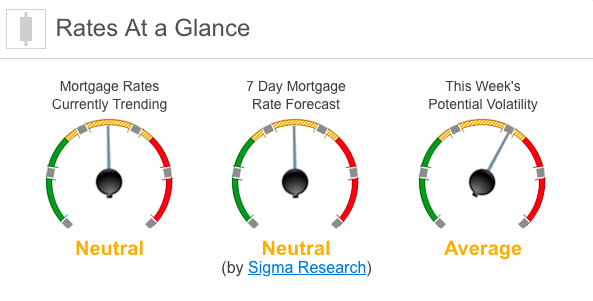

How Rates Move:Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours. Rates Currently Trending: NeutralMortgage rates are trending sideways this morning. Last week the MBS market improved by +8bps. This caused rates to move sideways on moderate volatility for the week. This Week’s Rate Forecast: NeutralThree Things: These are the three areas that have the greatest ability to impact mortgage rates this week: 1) The Fed, 2) Domestic and 3) Geopolitical 1) The Fed: We have a big week for Fed-speak. We will hear from Fed Chair Powell on three different days with the focus on Wednesday’s testimony in front of the House Financial Services Committee. Here is a complete schedule:

2) Domestic Flavor: We have some important domestic economic events that have the gravitas to move rates this week with the spotlight on Thursday’s CPI. 3) Geopolitical: We will go ahead and lump in Trade War into this category as well. Any real news on movement with China/U.S. will get plenty of attention but we also have auto tariffs with Europe (Germany) and tariffs with Vietnam that garnering attention. Iran/Syria are on the radar, and so is the implosion of one of the largest banks (Deutsche Bank). Also, the European Finance Ministers will meet. Treasury Auctions this Week:

This Week’s Potential Volatility: AverageThere are several moving parts this week that rate markets will have to pay attention to. Look for volatility to spike if Powel’s testimony deviates from the expectations of a rate cut. If he appears to signify to the markets that he thinks the economy is strong and doesn’t need the rate cut, then we could see volatility spike and rates tick higher. Bottom Line:If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them. |