Scottsdale Real Estate Update | July 1st, 2019

This Week’s Mortgage Rate Summary

How Rates Move:

Conventional overnment (FHA and VA) lenders set their rates based on the pricing of Mortgage Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

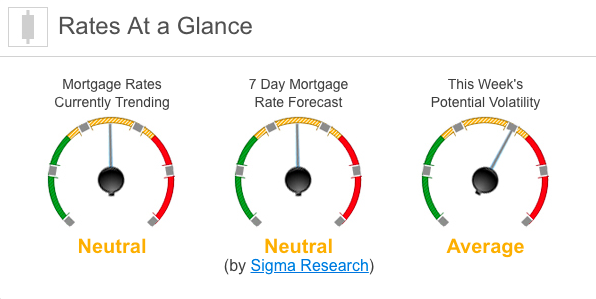

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market improved by +2bps. This caused rates to move sideways on relatively low volatility.

This Week’s Rate Forecast: Neutral

Three Things: These are the three key areas that have the greatest ability to impact mortgage rates this week. 1) Geopolitical, 2) Trade War and 3) Jobs.

1) Geopolitical: Now that President Trump has made a historical physical visit to North Korea, negotiations are back in focus, but markets will give the most attention to European Union meetings and the potential disciplinary action against Italy. Tuesday’s OPEC meeting will be important as well as rising escalation with protestors in Hong Kong, Iran, and Syria/Israel.

2) Trade War: The temporary “truce” with China over the weekend will stave off the next round of $300B in tariffs on consumer staples which was largely expected. Now the real work begins, and any real movement towards the toughest issues will get a lot of attention.

3) Jobs: We get a lot of jobs and income-related data this week that will culminate in Friday’s Jobs Report. The bond market will give the most weight to the YOY Average Hourly Earnings report, which is expected to tick up from 3.1% to 3.2%. But the headlines will go the Non-Farm Payrolls data that is expected to move back towards the trend in the 150K to 160K range. It will also be interesting to see what type of revision is made to May’s NFP reading of 75K.

Fed: Here is this week’s schedule:

-

07/01 Richard Clarida

-

07/02 John Williams, Loretta Mester

-

07/05 Fed’s Balance Sheet

This Week’s Potential Volatility: Average

With the July 4th holiday, we have an abbreviated trading week. The most crucial day for potential rate volatility will be Friday with the June jobs report. Until then, look for rates to move sideways at these low levels.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.