Scottsdale Real Estate Update | June 10th 2019

This Week’s Mortgage Rate Summary

How Rates Move:

Conventional overnment (FHA and VA) lenders set their rates based on the pricing of Mortgage Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

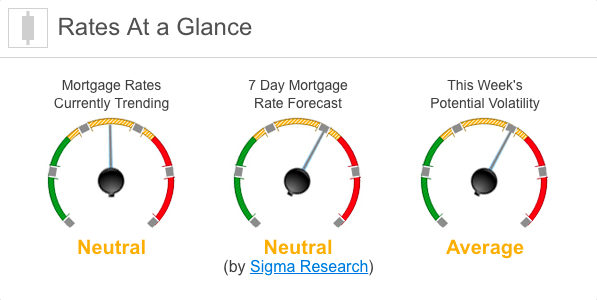

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market improved by +13 bps. This caused rates to remain very low. Rates experienced relatively low volatility.

This Week’s Rate Forecast: Neutral

Three Things: These are the three areas that have the greatest ability to impact rates this week. 1) Geopolitical/Trade, 2) Domestic and 3) Across the Pond

1) Geopolitical: Lots to focus on this week. British PM May is gone, and later this week we might know who her replacement will be and/or have another round of elections…..the results of which will determine how (and if) Great Britain leaves the EU and in what form. Trade continues to be front and center. While the Mexican immigration punitive tariffs have been put on hold, they are not gone. Mexico has pushed hard to meet the U.S. demands, but if they fizzle out in their border enforcement, then those tariffs will be back. On the Chinese front, there is much speculation on if Trump will meet with Xi at the upcoming G20 meeting. Meanwhile, both sides continue to ramp things up with another round of a new $300B in tariffs hitting next week.

2) Domestic: The biggest reports of the week will be Wednesday’s YOY Consumer Price Index Ex-food and energy which has been hovering around 2.1%. Any increase in that level would be negative for your rates and will be interesting to see if there are any upward pressure due to tariffs which we have not seen yet. Friday’s Retail Sales will also be watched very closely.

3) Across the Pond: We have some very key releases this week which have the gravitas to move rates:

-

China: Trade Balance, PPI, CPI, Retail Sales, Industrial Production, and an NBS Press Conference.

-

Japan: Industrial Production

-

Germany: CPI & Wholesale Prices

-

Great Britain: GDP & Unemployment Rate

-

Eurozone: ECB President Draghi Speech

Treasury Auctions this Week

-

06/10 3 year note

-

06/11 10 year note

-

06/12 30 year bond

This Week’s Potential Volatility: Average

Rates have a lot to pay attention to this week. Between the economic news and geopolitical concerns denoted above, rates have the potential to see a good deal of volatility if something unexpected occurs.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.