Scottsdale Real Estate Update | Monday August 6th, 2018

Today’s Mortgage Rate Summary:

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

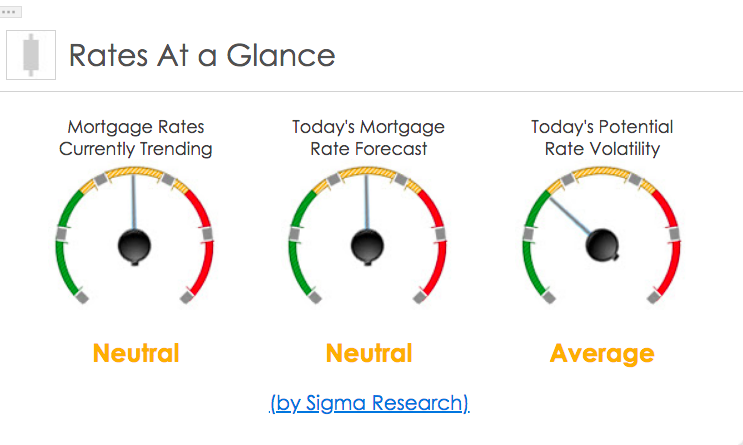

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by 11 bps. This was not enough to move rates last week. There was very little mortgage rate volatility last week.

Today’s Rate Forecast: Neutral

Three Things: These are the three areas that have the greatest ability to move rates this week. 1) Trade Wars, 2) Across the Pond and 3) Inflation.

1) Trade Wars: Plenty of “saber rattling” going on and none of it is giving markets any degree of comfort or certainty as to the scale and length of the Trade War. This not only includes China but also the Eurozone, NAFTA, and others.

2) Across the Pond: This week’s domestic data flow is coming from overseas with very critical readings from the world’s largest economies. We will get both PPI and CPI out of China as well as their foreign reserves report. Japan will give us the BofJ Summary of Opinions as well as their prelim Q2 GDP. Germany will release their production and construction data.

3) Inflation: We will get our PPI and CPI data with the bond market focusing on Friday’s Core (ex-food and energy) CPI YOY reading which is expected to remain at 2.3%

Treasury Auctions this Week:

- 08/07 3 year note

- 08/08 10 year note

- 08/09 30 year bond

The Fed:

- 08/08 Thomas Barkin

- 08/09 Charles Evans

Today’s Potential Rate Volatility: Average

Mortgage rates a likely to move sideways most of the week. The markets will be paying close attention to the inflation data at the end of the week. The markets will look out for a change in trade tensions with China.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today, contact your mortgage professional to discuss it with them.