Scottsdale Real Estate Update | September 4th, 2018

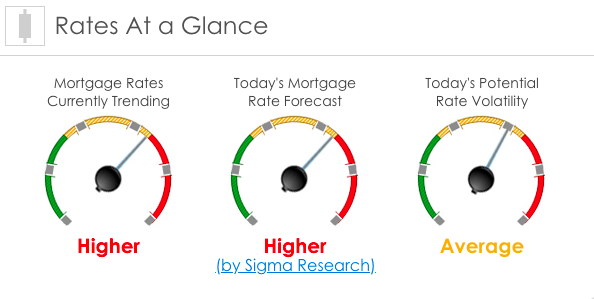

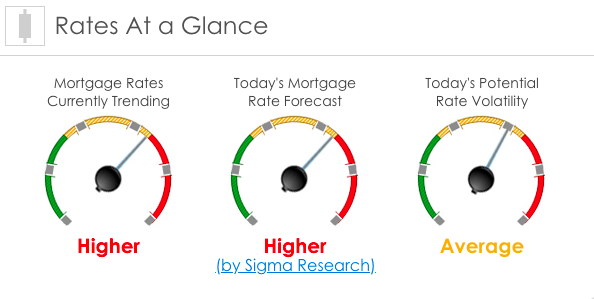

| Today’s Mortgage Rate Summary |

|

| Today’s Mortgage Rate Summary |

|

Frustrated by a bad experience, Barbara began her real estate career with a goal of providing exceptional service. Our motto is "A Name Friends Recommend." If you have a great experience then you will want your friends and family to have that same great experience.